In the realm of healthcare and insurance plans, navigating the intricacies of savings accounts and eligible expenses can feel like a puzzle. This rings especially true for individuals considering utilizing their Health Savings Account (HSA) or Flexible Spending Account (FSA) for speech therapy. Speech therapy, a vital service for individuals with communication disorders, can pose questions about reimbursement eligibility and IRS guidelines. In this article, we aim to unravel the mystery surrounding the use of HSA funds for speech therapy and other tools and resources that support individuals with ADHD, dyslexia, speech and hearing challenges, and other learning differences and learning disabilities. We’ll also cover other common HSA/FSA eligible items and FAQs about other products and services that are versus aren’t eligible.

Speech Therapy: Eligibility and Reimbursement

Speech therapy, often used to treat speech and language disorders, is considered a qualified medical expense by the IRS under certain circumstances. To determine whether HSA or FSA funds can be used for speech therapy, consider the following factors:

- Health Plan Coverage: Check with your health insurance provider to understand if speech therapy is covered under your plan. Some plans may require pre-authorization or have limitations on the number of sessions covered.

- Medical Necessity: For reimbursement, speech therapy must be deemed medically necessary. This means that a qualified healthcare provider, such as a physician or specialist, must diagnose the need for speech therapy to treat a medical condition.

- IRS Guidelines: According to IRS Publication 502, qualified medical expenses generally include the diagnosis, cure, mitigation, treatment, or prevention of disease. Speech therapy that is prescribed to treat a medical condition may be eligible for reimbursement. However, therapy aimed at improving communication skills or enhancing public speaking may not qualify.

- Documentation: Keep thorough records of expenses related to speech therapy, including invoices, receipts, and any documentation from healthcare providers. This documentation will be essential for reimbursement and may be required for tax purposes.

Other HSA Eligible Accessibility Products

In addition to the more common eligible expenses, HSA funds can also be used to cover the cost of various accessibility products and home modifications including:

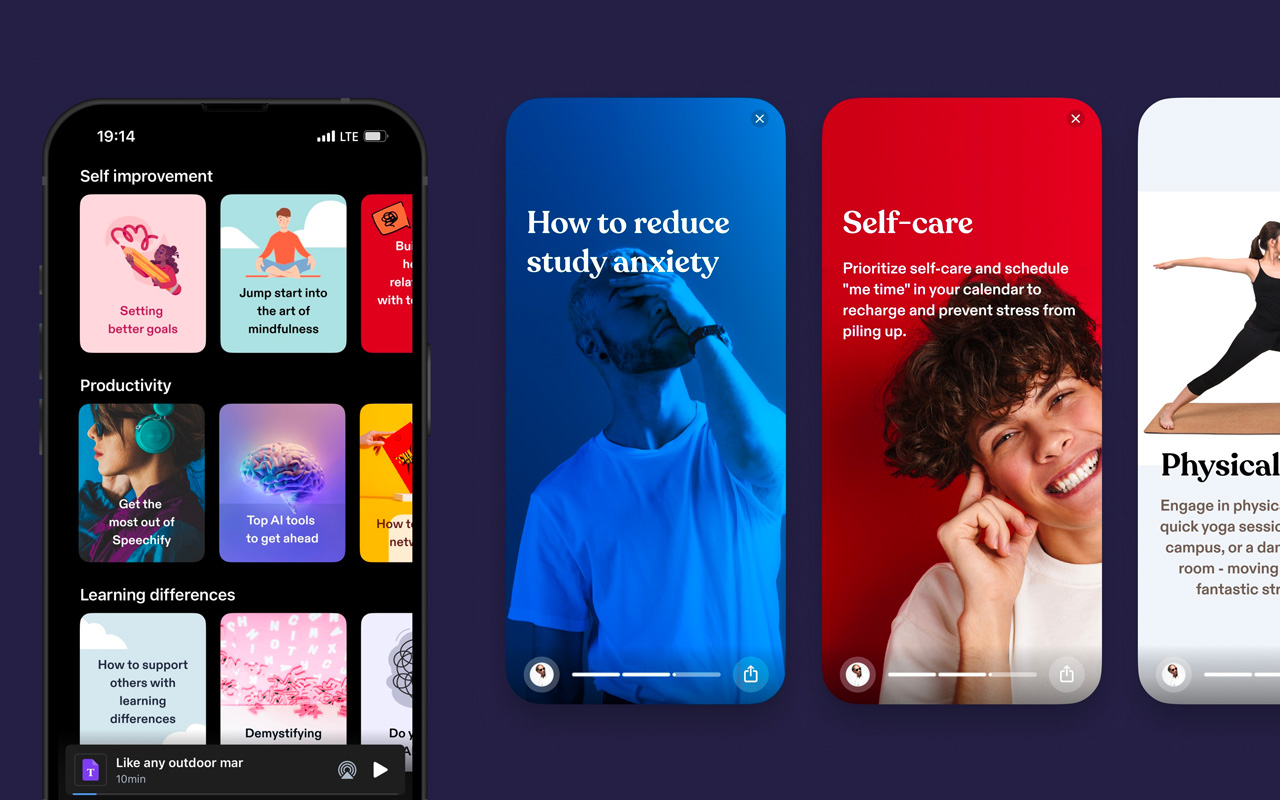

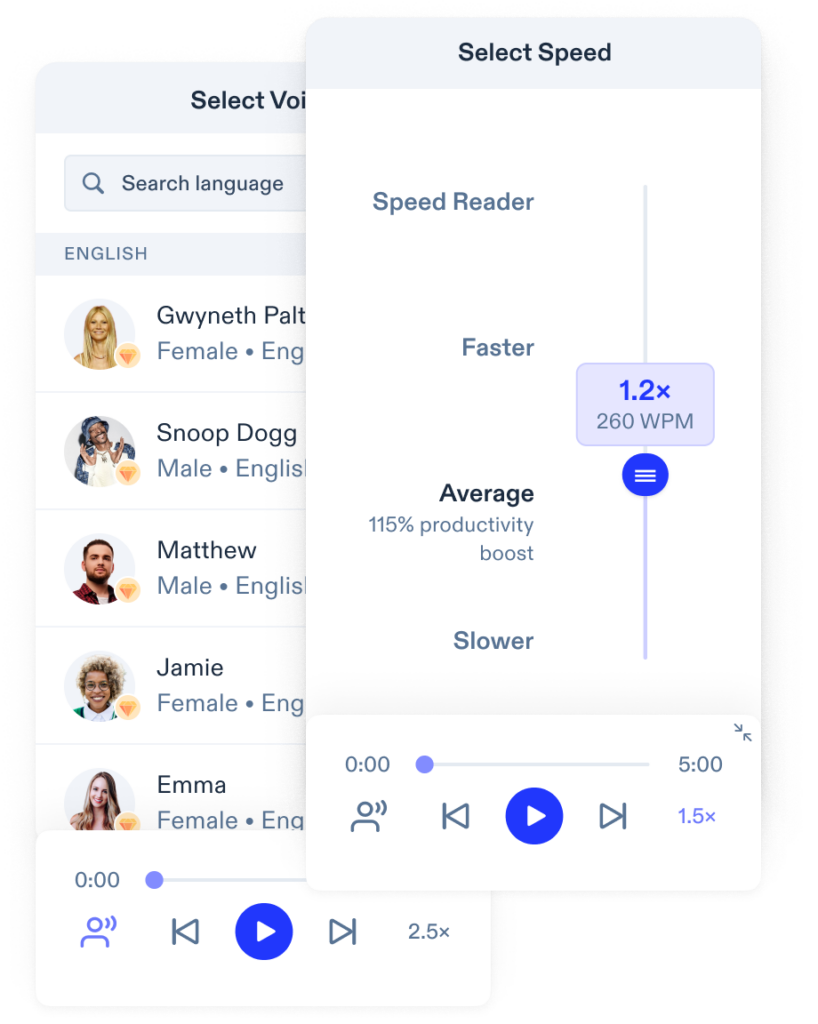

- Speechify’s text to speech app and other specialized computer equipment and software

- Wheelchairs, walkers, artificial limbs, canes, and other mobility aids

- Braille books and magazines

- Guide dogs and other service animals

- Ramps, grab bars, and other home modifications to improve accessibility

- Hearing aids, cochlear implants, and other assistive devices

What Else can I Purchase Using my HSA/FSA?

Skincare, Sunscreen, and More

One unexpected HSA-eligible expense is sunscreen. The IRS considers sunscreen with SPF 15 or higher to be a qualified medical expense. Other skincare items like moisturizers, lotion, lip balm, anti-itch creams, and other ointments can also be reimbursed through your HSA if they are used to treat a specific medical condition.

Women’s Health

Thanks to the CARES Act, feminine hygiene products like tampons, pads, and menstrual cups are now considered qualified medical expenses that can be paid for with HSA or flexible spending account (FSA) funds. Birth control is another common use case for HSA spending. This helps make these essential healthcare items more accessible and affordable.

Products for Parents

New parents can use their HSA funds to cover the cost of breast pumps and related supplies. Family planning expenses, pregnancy tests, and baby monitors are other common products that can be purchased with most HSAs to avoid out-of-pocket expenses. Other family planning medical costs, including Infertility treatments and vasectomies can also be eligible for payment using a HSA, depending on various factors.

Over-the-counter Medications

Many over-the-counter (OTC) medications and supplements can be reimbursed through your HSA, including pain relievers, allergy medicines, laxatives, antacids, and more. You may need a prescription or letter of medical necessity from your doctor for some OTC items to qualify.

Vision and Dental Expenses

HSA funds can be used to pay for a wide range of vision expenses and dental expenses, such as prescription eyeglasses, contact lenses, eye drops, dental cleanings, fillings, braces, artificial teeth, eye surgery, and even some cosmetic procedures if they are medically necessary.

Other Well-being Products

Other unexpected HSA-eligible expenses include smoking cessation programs, weight-loss programs (with a letter of medical necessity), and first-aid supplies.

Conclusion

In conclusion, the use of HSA or FSA funds for different products and services, including speech therapy, accessibility tools/resources, and other health and wellness products, depends on various factors, including health plan coverage, medical necessity, and IRS guidelines.

While speech therapy can be a qualified medical expense under certain circumstances, it’s crucial to consult with healthcare providers and review your plan’s coverage to ensure eligibility for reimbursement. By understanding the nuances of HSA and FSA regulations, individuals can make informed decisions regarding their healthcare expenses, including speech therapy.

FAQs

Is speech therapy an eligible expense/qualified medical expense for Health Savings Account (HSA) reimbursement?

Yes, if speech therapy is deemed medically necessary to treat a medical condition, it is considered an eligible expense for HSA reimbursement according to IRS guidelines.

Is speech and language therapy FSA eligible?

Speech and language therapy may be eligible for reimbursement from a Flexible Spending Account (FSA) if it is deemed medically necessary and not covered by insurance.

Does insurance cover speech therapy?

Coverage for speech therapy varies depending on the individual’s health plan. Some plans may cover speech therapy as part of their benefits, while others may require pre-authorization or have limitations on coverage.

Can I use HSA for talk therapy?

Generally, talk therapy or psychotherapy may be eligible for HSA reimbursement if it is prescribed to treat a diagnosed medical condition such as anxiety or depression.

Can you use HSA for occupational therapy or physical therapy?

Occupational therapy is generally considered a qualified medical expense for HSA reimbursement if it is prescribed to treat a medical condition. You can also use a HSA for physical therapy expenses if the treatment is prescribed by a healthcare provider to address a medical condition.

Are HSAs and FSAs the same?

Both HSAs and FSAs are tax-advantaged accounts that allow individuals to set aside pre-tax dollars for qualified medical expenses.

Health Savings Account (HSA): An HSA is a tax-advantaged savings account available to individuals enrolled in a High-Deductible Health Plan (HDHP). Contributions to an HSA are tax-deductible, withdrawals for qualified medical expenses are tax-free, and the unused balance can roll over from year to year.

Flexible Spending Account (FSA): On the other hand, an FSA is a pre-tax savings account that an employer may offer as part of a benefits package. Unlike HSAs, FSAs must be used within the plan year or grace period, or the funds are forfeited.

When assessing if you can use your HSA or FSA for speech therapy coverage, among other expenses mentioned in this article, it’s also important to consider the differences between HSAs and FSAs. Always consult your specific plan (private insurance, Medicare, IRS guidelines, and HSA/FSA plans to make sure care expenses are properly aligned with policies.

How does the small business health care tax credit work?

The small business health care tax credit is available to small employers who provide health insurance to their employees. Eligible employers can receive a tax credit of up to 50% of their contributions towards employee premiums.

Can you use an HRA and HSA together?

Yes, individuals can use a Health Reimbursement Arrangement (HRA) and HSA together to maximize healthcare savings. The HRA can reimburse qualified medical expenses not covered by the HDHP until the deductible is met.

What documentation is required for submitting a claim for reimbursement?

Documentation such as invoices, receipts, and explanations of benefits (EOBs) from healthcare providers is typically required when submitting a claim for reimbursement from an HSA or FSA. To be safe, save your medical records, and proof of debit card or credit card purchases.

Can I use an HSA to pay for existing medical conditions?

Yes, you can use a HSA to pay for medical expenses related to existing medical conditions. This can include expenses such as doctor visits, prescription medications, medical procedures, durable medical equipment, and other treatments necessary to manage or treat existing health conditions. For example, if you have a condition such as diabetes, medical expenses, including co-payments can be paid via an HSA.

Can you use an HSA/FSA to pay for dependent care?

Expenses related to dependent care, such as daycare, after-school care, or elder care services, are generally not considered qualified medical expenses eligible for HSA spending. Individuals may utilize FSAs or Dependent Care Flexible Spending Accounts (DCFSA), to cover eligible dependent care expenses.

Can I use my HSA for massages?

No, massage therapy is generally not considered a qualified medical expense for HSA reimbursement. Acupuncture and chiropractor services, however, can be eligible for HSA spending if prescribed by a healthcare provider for a medical condition.

What other expenses can an HSA be used for?

The expenses mentioned above do not represent a comprehensive list of qualified medical expenses and medical care services that are eligible for HSA/FSA spending. There are a wide range of additional qualified medical expenses, including but not limited to doctor visits (inpatient and outpatient), prescription medications, vaccinations, x-rays, medical equipment, and certain preventive care services. Please consult IRS guidelines and your specific plan for a comprehensive guidance.